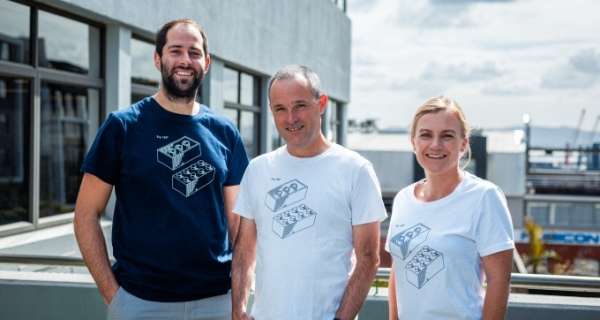

Root, a startup based in Cape Town that is building infrastructure for the digital insurance economy, has raised $3 million in seed funding. Along with primary investors Invenfin, Base Capital, Savannah Fund, P1 Ventures, Luno, and FireID, a select group of high-impact angel investors took part.

Root plans to use the funds to expand its low-code digital insurance platform to innovators in new markets.

Root is a cloud-native end-to-end insurance platform that enables businesses of all sizes to quickly design, sell, and manage digital insurance products and communicate with customers through modern channels.

The company was founded in 2016 with the purpose of breaking down barriers to financial services innovation. Root packages insurance’s “hard things” and offers programmable insurance products through simple APIs.

In the South African market, the company has met strong demand, powering some of the country’s largest affinity insurance companies. Root’s insurance infrastructure processes millions of policies and thousands of claims each month for clients such as Mr Price Money, FinChoice, Telkom, Metropolitan, and Guardrisk.

“As Root continues to unlock innovation in insurance, we are making it easier for innovators to put customers first and take the industry into the age of truly personalized and convenient embedded products,” says Louw Hopley, CEO and co-founder. “Closing this funding means that we can power more innovators, globally, and accelerate the process of transformation.”

Stuart Gast (CEO at Invenfin) adds that “We have been following Root closely over the last few years and are delighted to be partnering with the team as they enter this new phase of scaling the business. We are confident that Root is positioned to have a massively positive impact on insurance, both in South Africa and abroad.”

0 Comments